Buying insurance policies is not something most people think of and usually do not consider until an unforeseen accident or significant life event prompts people to give it some thought. In the Philippines, many people avoid buying an insurance policy because they lack knowledge about it or believe it is an unnecessary expense.

Compared to other countries in the west, insurance is still a growing industry in the Philippines as most Filipinos give less value to insurance protection. Over time, the number of people purchasing insurance coverages increased significantly. However, many remain financially unprotected.

Another reason people avoid buying insurance is that they do not understand potential financial risks. For example, people may have the means to afford one but choose not to buy it as they deny knowing chances. They do not realize that a significant life event or accident may lead to substantial losses and cost more than expected.

While all types of insurances are equally important, home insurance is one of the most overlooked. When it comes to our homes, we ensure everything we dream of having is in them, from furniture, lighting, security system, and even our most treasured possessions.

A home is an investment that can last for a lifetime. As such, it makes sense to want to keep it protected from anything that might destroy the asset. As a homeowner, it is your responsibility to consider all safety measures, including purchasing the correct.

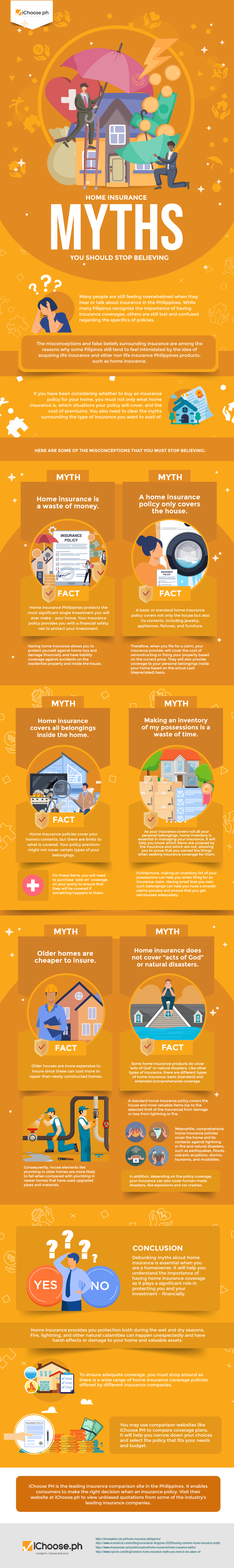

Unfortunately, many shy away from purchasing one as not everyone realizes the importance of ensuring one’s house. The lack of knowledge regarding types of insurance often leads to misunderstandings and beliefs in various misconceptions, which is the leading reason why Filipinos still feel intimated by acquiring insurance products.

If you have been considering buying an insurance policy for your home, you should not let misconceptions hinder you from making a wise decision. Otherwise, here are some risks you may face if you do not get one:

• Paying out-of-pocket for damages to your home – The primary purpose of a home insurance policy is to provide coverage for the cost of replacement for any losses or damages due to covered perils.

While choosing not to buy a home insurance policy might seem like a financial boost, the cost of repairing the damage may be more expensive, and injuries without coverage require you to pay out of pocket. It means you will be responsible for complete replacement.

• Your property will have no protection – A home insurance policy is more than just protecting the structure of a home. Depending on the policy availed, it can also cover any lost or damaged household possessions. In the event of a significant event, you may lose not just your home but all your valuables as well.

• If your home is burglarized, you may not have enough to replace your belongings. In the event of theft and break-in, it is your responsibility to cover the costs of returning all your belonging without insurance.

• You have no liability protection – Do you know that if someone is injured on your property, you are responsible and worse, you can get sued? Without the protection of homeowners insurance, there are many expenses you will have to face. Even a superficial injury such as a trip and fall can cost significant hospital bills. Such fees can quickly add up and lead to debt if failed to be settled.

Prevent such risks from happening by having adequate protection. Find the right coverage suitable for your needs by looking at a comparison website insurance Philippines.

Read More: Advantages of Joining a Car Club

More importantly, debunk some myths about home insurance so it will not prevent you from having the protection your home deserves. To learn more, read this infographic from iChoose.